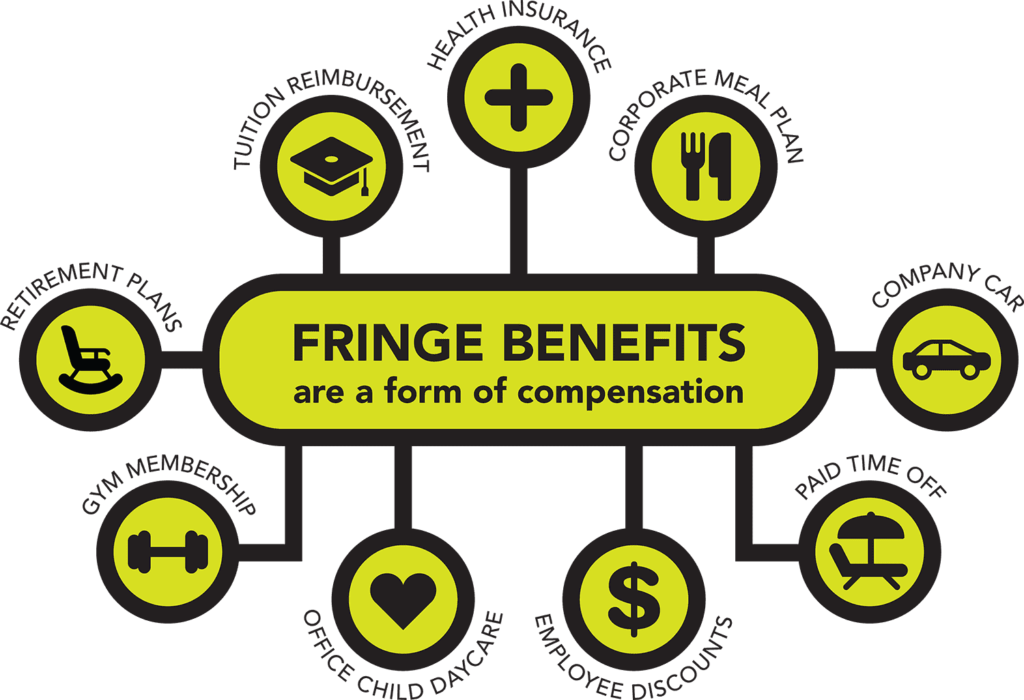

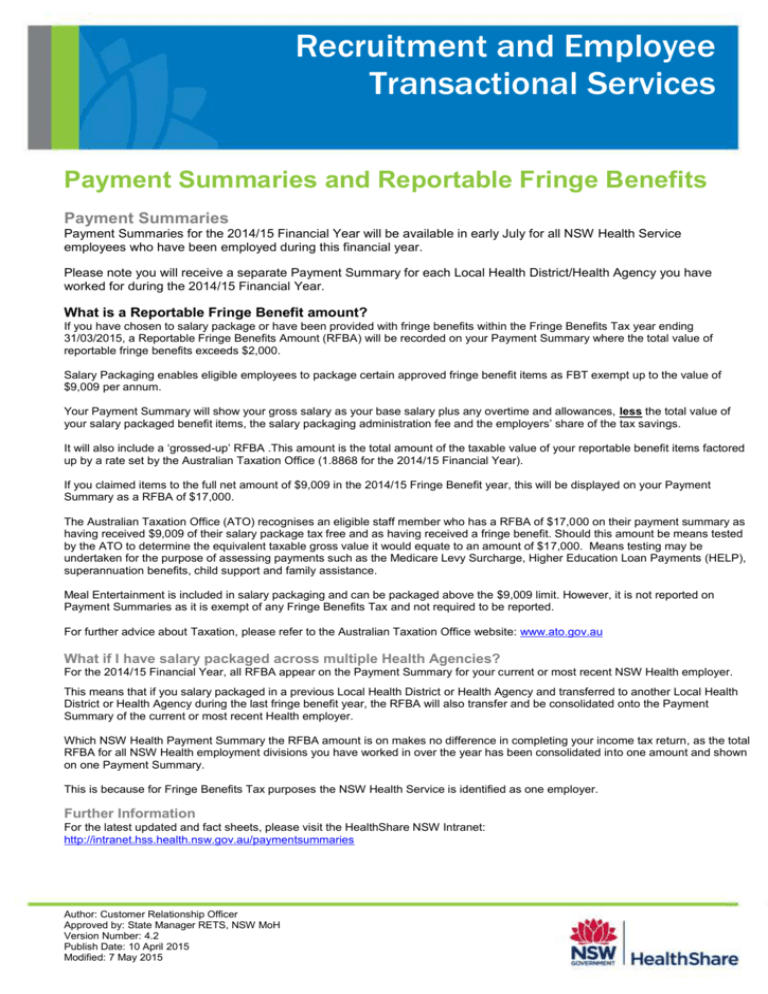

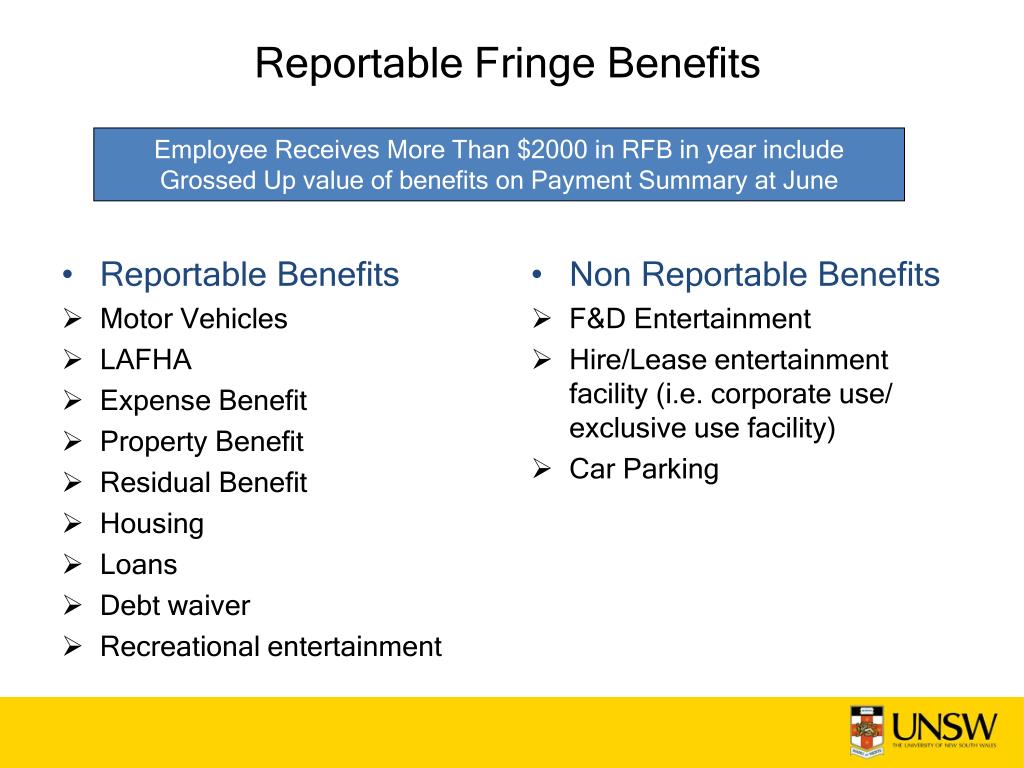

What is a Reportable Fringe Benefits Amount (RFBA)? If the total taxable value of the fringe benefits provided to you and/or your family in a FBT year exceeds $2,000, you’ll have a reportable fringe benefits amount in your end of financial year income statement (formerly called a payment summary). Some fringe benefits, like meals.. Fringe benefits demonstrate to the employees that you care for them, improving employee satisfaction and loyalty. Ensure good health of employees. If employees are unable to work due to ill-health.

PPT SPECIAL TREATMENT OF FRINGE BENEFITS PowerPoint Presentation, free download ID1632303

The Comprehensive Guide to Fringe Benefits AttendanceBot

Fact Sheet Reportable Fringe Benefits

Fringe Benefits What Are They and How They Benefit You Locmans Advisors

Advanced Tax Law Chapter 17 Fringe Benefits

What is Fringe benefit tax (FBT)? Intraday trading, Fringe benefits, Stock options trading

PPT What is FBT PowerPoint Presentation, free download ID4737749

Fringe Benefit Tax bartleby

22. Fringe benefits and allowances Wages and Compensation Human Resources YouTube

:max_bytes(150000):strip_icc()/fringe-benefits.asp-final-d5218f87c38c43ad9189b81be15a83ce.png)

What Are Fringe Benefits? How They Work and Types

Unlocking the Potential of TaxFree Fringe Benefits A Comprehensive Guide Shiftbase

Fringe benefit considerations for small businesses Magazine

What Are Fringe Benefits? It Business mind

4 Ways to Calculate Fringe Benefits wikiHow

What Are Fringe Benefits? It Business mind

Fringe Benefits Blitz for 2022 Taxing and Reporting Fringe Benefits YouTube

Fringe Benefits Tax

Reportable Fringe Benefits AtoTaxRates.info

What Are Fringe Benefits? Definition and Examples

Fringe Benefits Tax Business Fitness Help & Support

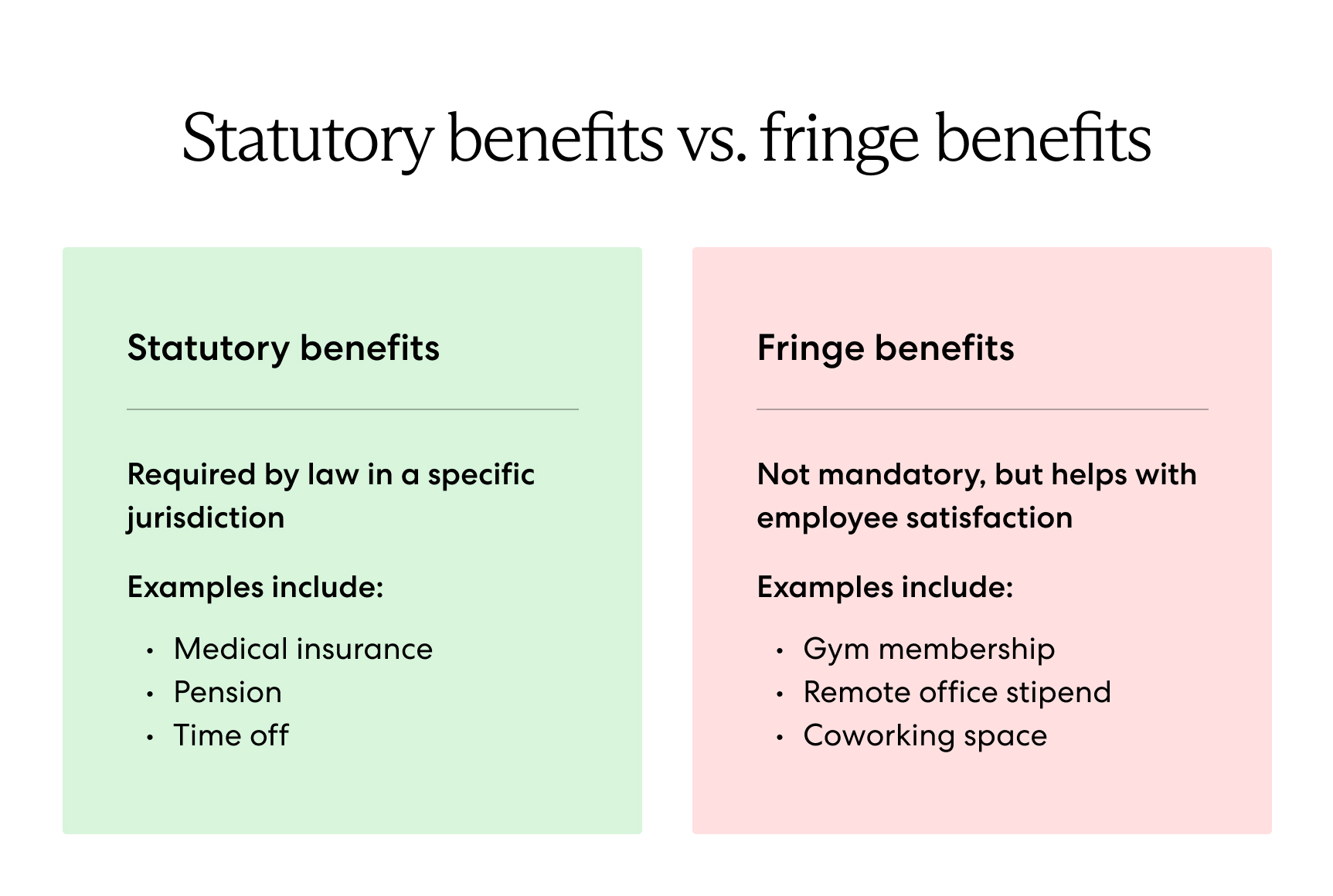

Their fringe benefits package is valued at $30,000. Dividing the value of the benefits package by their yearly salary and then multiplying by 100, we get a fringe benefit rate of about 31.6%. What this translates to is the firm paying just under a third of the engineer’s salary in additional compensation.. Fringe benefits are supplementary perks, incentives, and advantages offered to employees on top of their regular salary or wages. They’re designed to improve the overall employee experience and.